Whereas San Francisco’s homeowners have increased their home improvement efforts when home values have risen, the city’s landlords appear to have done the opposite during the recent increase in rents. A likely explanation is that as competition over rentals intensifies, landlords face shorter periods of vacancy in which to renovate as well as a diminished incentive to do so. San Francisco tops the list of US cities with the least affordable homes, and the finding suggests yet another dimension along which homeowners’ and renters’ standards of living are diverging.[/box]

We recently used our collection of building permit data at BuildZoom to explore whether remodeling and [tooltip tip=”Remodeling and home improvement activity refers to all residential remodeling and maintenance projects that require a building permit, and which are not associated with new construction. When an area experiences a high level of home improvement activity, it means that homes in the area are maintained in good repair, and that they undergo sufficiently frequent updates and upgrades for the homes’ overall quality to improve. If an area experiences too little home improvement activity over a length of time, it eventually falls into disrepair.”] home improvement activity[/tooltip] in San Francisco has tended to rise or fall with home prices and rents. From the BuildZoom Remodeling Index, we know that home improvement activity in San Francisco has been rising steadily since 2009, but we wanted to better understand the surge in home improvement.[1] Common intuition is that the increase in remodeling activity is part of the recovery from the Great Recession, and that it must be closely tied to rising home prices and rents. While the intuition is consistent with what we saw with respect to home prices, we were in for a surprise when we looked at rents.

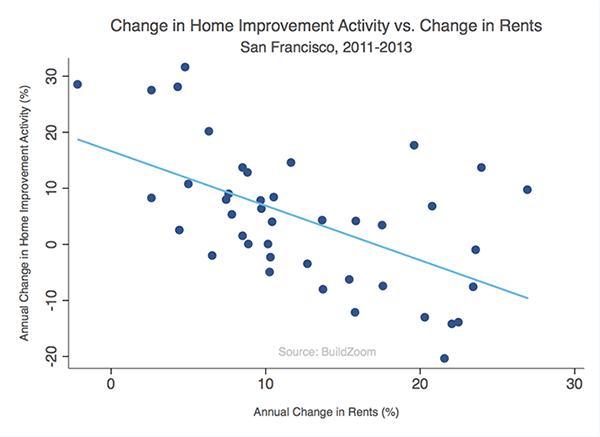

San Francisco zip codes in which rents increased more steeply have actually tended to see remodeling and home improvement activity increase less than elsewhere, and in some cases even decline. Using data on housing costs from Zillow in conjunction with our building permit data, we estimate that from 2011 to 2013 a 10% increase in rents in a zip code area was accompanied, on average, by a 9.7% decrease in the number of homes undergoing improvement.

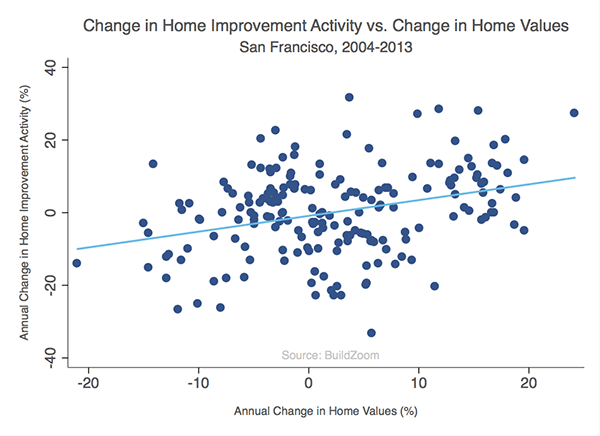

In contrast, remodeling and home improvement activity tended to increase more in zip codes with greater increases in home values, as opposed to rents. From 2004 to 2013 we estimate that, on average, a 10% increase in home values was associated with a 4.3% increase in the number of homes undergoing permitted improvement.[2]

What do we make of this?[4] Rising rents are a reliable indication that competition among renters is intense, which enables landlords to minimize vacancy periods. Apart from the intended effect of avoiding gaps in rental income, shorter vacancies also generate a side effect: they reduce the odds that substantial home improvement projects will take place. We suspect this consequence is one of the main reasons we observe less home improvement activity when rents are increasing. Another, closely related reason is that when eager renters are lining up at the door, landlords have less incentive to renovate. If one can make top dollar renting a place out as-is – why not?

San Francisco already tops the charts as the least affordable city in the US. By one measure – from Trulia’s Chief Economist Jed Kolko – a household earning the city’s median income in May of 2014 could afford only 14% of homes for sale in the city at that time. It is not surprising, therefore, that the lion’s share of San Francisco residents are renters (63.1%), and that households renting in the city tend to have much lower incomes than those which own their homes.[5] In a sense, the people of San Francisco already belong to two distinct classes – homeowners and renters – and rising home values are making it ever more difficult for renters to cross the line.

Our finding with respect to home improvement and rents – coupled with our speculation about its cause – suggests that renters in San Francisco are getting the short end of the stick. They are increasingly priced out of buying a home, and the intense competition that ensues for rentals does not just raise the rent, it also prevents rental homes from being upgraded or even maintained as well as they would be otherwise. As a result, the disparity between San Francisco’s homeowners and renters is spreading beyond the state of their financials and into the state of their homes.

[ilink url=”https://www.buildzoom.com/blog/wp-content/uploads/growing-divide-full-report.pdf” style=”download”]Download the PDF version of the report[/ilink]

[hr]

[1] The BuildZoom Remodeling Index captures changes over time in remodeling and home improvement activity. The index for the city of San Francisco has been rising steadily since 2009 when, during the great recession, home improvement in the city hit a low point. By the end of 2013 home improvement had climbed back to 90% of its peak level before the recession.

[2] We were able to estimate the relationship with respect to home values farther back than we were able to for rents because Zillow’s home value data goes back farther than its rent data.

[3] Zip code 94158, Mission Bay, has been omitted because it overwhelmingly consists of new construction. Zillow home value and rent information is unavailable for zip codes 94104, 94129 and 94130 because they have very few residential properties, so these zip codes have also been omitted.

[4] A rather unexciting explanation for our findings is that in some areas, homes may have experienced both a greater increase in rents and less home improvement because they were in better condition prior to when we observe them (homes in better condition obviously require less home improvement, and they may draw higher rents as well). We were able to account for this possibility in our estimates, and it does not appear to be driving the result. More details are available in the technical account of our analysis.

[5] According to the 2013 American Community Survey, the share of San Francisco households with annual incomes over $150,000 was more than double among owner-occupant households (37.7%) than it was among households renting their homes (18.4%).

Leave a Reply